The Difference Between Positive and Negative Gearing

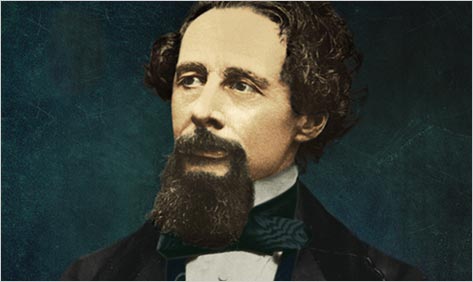

“Annual income twenty pounds, annual expenditure nineteen nineteen and six, result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery.”~ David Copperfield

Whoever thought that two hundred years ago Charles Dickens would be describing the difference between positive and negative gearing!

Over my years of investing it has really surprised me to discover how many people do not know the difference between positive and negative gearing.

It really is as simple as Charles Dickens explained of making sure that the entire income from any Rental property is more than the expenses.

When weighing up the expenses you must include everything: the sale price, stamp duty, solicitor’s fees, land tax, council rates, water rates, renovations & repairs and, if it’s a unit, strata fees. Strata fees can be a killer. Many people have got out of holding a unit just because the strata fees were too expensive.

Did you know that only 10% of people in Australia have an Investment Property and of that 10% only 5% have more than two?

If you would like to have a positive Cash-flow investment portfolio to give you a secure retirement then I suggest that, as this is close to the beginning of the year, you should plan to buy at least one investment property this year.

In my coaching program I help people build up their portfolio over their working life so that they have several properties bringing in a positive cash-flow, passive income to secure their retirement.

How many properties do you think you could buy if your properties were negative geared? Because you’re paying for them, out of your salary, you will probably only be able to afford two. However if you have positive geared properties and you can show the bank that the loans can be serviced you should be able to afford an indefinite number!

Nowadays, with interest rates below 5%, it’s a lot easier to find positive geared properties, where the rent will cover the mortgage repayments. However, what if interest rates increase? How would you cope when they do go back to 7, 8 or 9 percent if your property is already negative geared?

So if you plan to retire before you are 70 on more than the aged pension, I strongly recommend investing in property with some expert advice.

Discover the 7 questions you need to ask yourself before buying an investment property go to the opt-in box at the right of page NOW for your Free Tips!

Anita Fursland

Positive Properties

02 9545 5005

0405 100 146

www.positiveproperties.com.au

anita@positiveproperties.biz